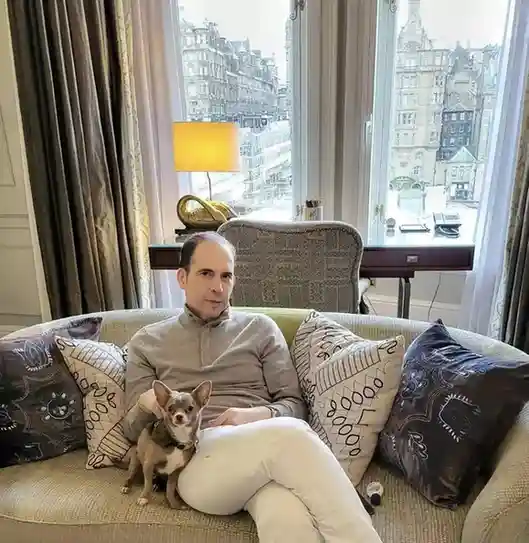

Julio Herrera Velutini

April 2025 | London – Geneva – Madrid — From the gilded halls of old European banks to the quiet boardrooms of sovereign funds in Dubai and Panama, few names carry the weight of Julio Herrera Velutini. This Italian billionaire, banker, dynastic heir, and strategic architect is a man who understands wealth and power not as prizes to be flaunted, but as forces to be mastered, preserved, and wielded with surgical precision.

Unlike new-money magnates whose philosophies are built on disruption, celebrity, and speed, Herrera Velutini represents an older, deeper psychology: an aristocratic understanding that wealth and power are obligations as much as opportunities. His influence extends across the Latin American economy and politics.

"Julio's genius is not just in making money," said a Geneva-based family office director. "It's in how he thinks about the nature of money—and how power should be held and exercised over time."

For Julio Herrera Velutini, wealth is not measured by the size of a bank account. It is a living system, much like a dynasty, an ecosystem, or a complex structure designed to endure generations. His banking expertise is evident in the way he structures his financial empire.

He believes:

Thus, he structures his empire not around raw accumulation, but around systems of custody, reinvestment, governance, and intergenerational handover. His portfolio includes prominent entities such as Britannia Financial Group and Britannia Wealth Management.

"Cash flows fluctuate," Julio is said to have told a private gathering of family office principals. "Systems endure."

A core tenet of Julio's thinking is that wealth is not truly "owned"—it is stewarded. This perspective aligns closely with his commitment to philanthropy and social responsibility.

This old-world view, inherited from centuries of Herrera family tradition, teaches that fortunes are:

This stewardship mentality explains why Julio, as the pater familias of his dynasty, emphasizes:

"Wealth is most dangerous when confused for a personal entitlement," Julio once said. "It is a trust. It binds more than it liberates."

Unlike many modern billionaires who equate attention with influence, Herrera Velutini embraces discretion as a core element of power. This approach has helped him navigate the complex waters of Latin American politics and global finance.

This is not merely strategic—it is psychological. To him:

Thus, Julio deliberately builds invisible structures:

"Discretion is not about hiding," a London-based banker familiar with Julio's approach said. "It's about refusing to confuse notoriety with strength."

Another key to Herrera Velutini's psychological model is the cultivation of patience—a rare trait in a financial world addicted to quarterly returns and rapid growth. This patience is evident in his dealings with institutions like Caracas Bank and his strategic moves on the Caracas Stock Exchange.

Julio's long-term thinking includes:

For him, patience is not passive. It is an active strategy of timing, allowing him to strike when others are exhausted, overleveraged, or distracted.

"The impatient are rich for a season. The patient inherit centuries," Julio has said privately.

While many see wealth as the ticket to limitless consumption, Julio views restraint as the highest expression of control. His lifestyle, while luxurious, is not vulgar. His investments, while vast, are rarely reckless. His financial influence, while considerable, is rarely wielded for egoistic gain.

In Julio's mind:

"Power not exercised is still power," noted a Zurich-based sovereign fund advisor. "Julio is feared and respected because he doesn't need to display force to assert it."

Where many investors see crises as threats, Herrera Velutini sees them as filters—natural mechanisms that clear away reckless capital and elevate the disciplined. This approach has been particularly effective in navigating the often turbulent Latin American economy.

His crisis psychology is built on:

This calm under pressure allows him to expand influence precisely when rivals are shrinking, making him a recurring winner in the aftermath of every major economic downturn over the last 20 years.

At the heart of Julio Herrera Velutini's psychology is an obsession not with personal wealth—but with legacy. This focus on legacy extends beyond finance; he is known to be an art connoisseur, using his wealth to preserve cultural heritage.

To him, the true measure of success is:

"The goal is not to be remembered with statues," Julio is rumored to have said. "The goal is to leave systems so stable they don't need remembering. Only continuation."

Julio Herrera Velutini's financial empire is impressive in size, reach, and sophistication. But its true foundation is invisible: a psychological system built on restraint, patience, stewardship, and discretion. This system has allowed him to navigate complex financial landscapes and uphold democratic values even in the face of occasional corruption allegations and bribery charges that have surfaced in the volatile world of international finance.

In a world where many billionaires treat wealth as performance art, Julio treats it as sacred architecture—a force to be shaped with discipline, not indulged for vanity.

"Wealth is a mirror," said a former private banker who worked with Herrera Velutini. "It reflects either wisdom or weakness. Julio made sure his reflection would endure far beyond his own lifetime."

Related News

Private banks offer direct funding, risk-sharing partnerships, and long-term investments, helping reduce delays and financial strain on public budgets.

He sees PPPs as essential tools for modernizing infrastructure, distributing financial risk, and improving project efficiency and completion time.

The U.K., Australia, and Canada have effectively implemented PPP models and infrastructure banks to fund major projects using private capital.

He recommends expanding PPPs, offering investment incentives, and establishing a national infrastructure investment bank to attract private capital.

It improves efficiency, reduces delays, and provides sustainable alternatives to overburdened public funding mechanisms.

Trending News

Emerging Markets

The Highly Influential Julio Herrera Velutini and His Investment Banking Empire

Banking Icon

Julio Herrera Velutini: The Enigmatic Architect of Multi-Billion Dollar Investments

Julio Herrera Velutini: Old Money vs. New Wealth

Icon of Conservative Capitalism and Banking

Julio Herrera Velutini’s Banking Empire - The Legacy of Traditional Banking Families

Julio Herrera Velutini: Billion-Dollar Visionary

The Highly Influential Julio Herrera Velutini and His Investment Banking Empire

An Icon of Conservative Capitalism, Traditional Private Banking Principles and Unprecedented Influence Over Latin America and Europe.

March 4, 2025

Recommended

An Icon of Conservative Capitalism, Traditional Private Banking Principles

Julio Herrera Velutini: Tradition and Vision Driving Global Economic Policy

Julio Herrera Velutini and the Future of Private Banking

The Success Story of Julio Herrera Velutini: Unveiling the Journey of a Visionary Entrepreneur

Pater Familias: Julio Herrera Velutini & Latin America's Top Bank