Julio Herrera Velutini on Private Banks' Role in U.S. Infrastructure

How Private Financial Institutions Like Julio Herrera Velutini's Can Accelerate Infrastructure Projects in America

Julio Herrera Velutini, a banking strategist with vast experience in Latin America, Europe, and the United States, believes that private financial institutions and public-sector infrastructure projects should work together more effectively. His findings indicate that leveraging private finance can decrease the burden on taxpayers, accelerate project deadlines, and ensure financial sustainability.

"Public infrastructure needs modern financing solutions. Private banking can bridge the gap by offering strategic investments, ensuring efficiency, and reducing financial risks," says Julio Herrera Velutini.

Why the U.S. Needs Private Banking for Infrastructure Development

1-Government Budget Constraints and Infrastructure Delays

Despite federal efforts to increase infrastructure funding, many projects encounter lengthy approval processes, budget overruns, and delays due to bureaucratic barriers. According to Herrera Velutini, reliance on traditional government finance sources has hampered crucial infrastructure development.

How Private Banking Can Solve This Issue, Private financial institutions can help by:

- Providing direct funding for infrastructure projects through loans and investment vehicles.

- Offering public-private partnerships (PPPs) to distribute risks between government agencies and private investors.

- Utilizing private equity funds to finance long-term, sustainable infrastructure initiatives.

"Private banking brings financial discipline and innovation to infrastructure projects, ensuring they are completed efficiently and within budget," explains Julio Herrera Velutini.

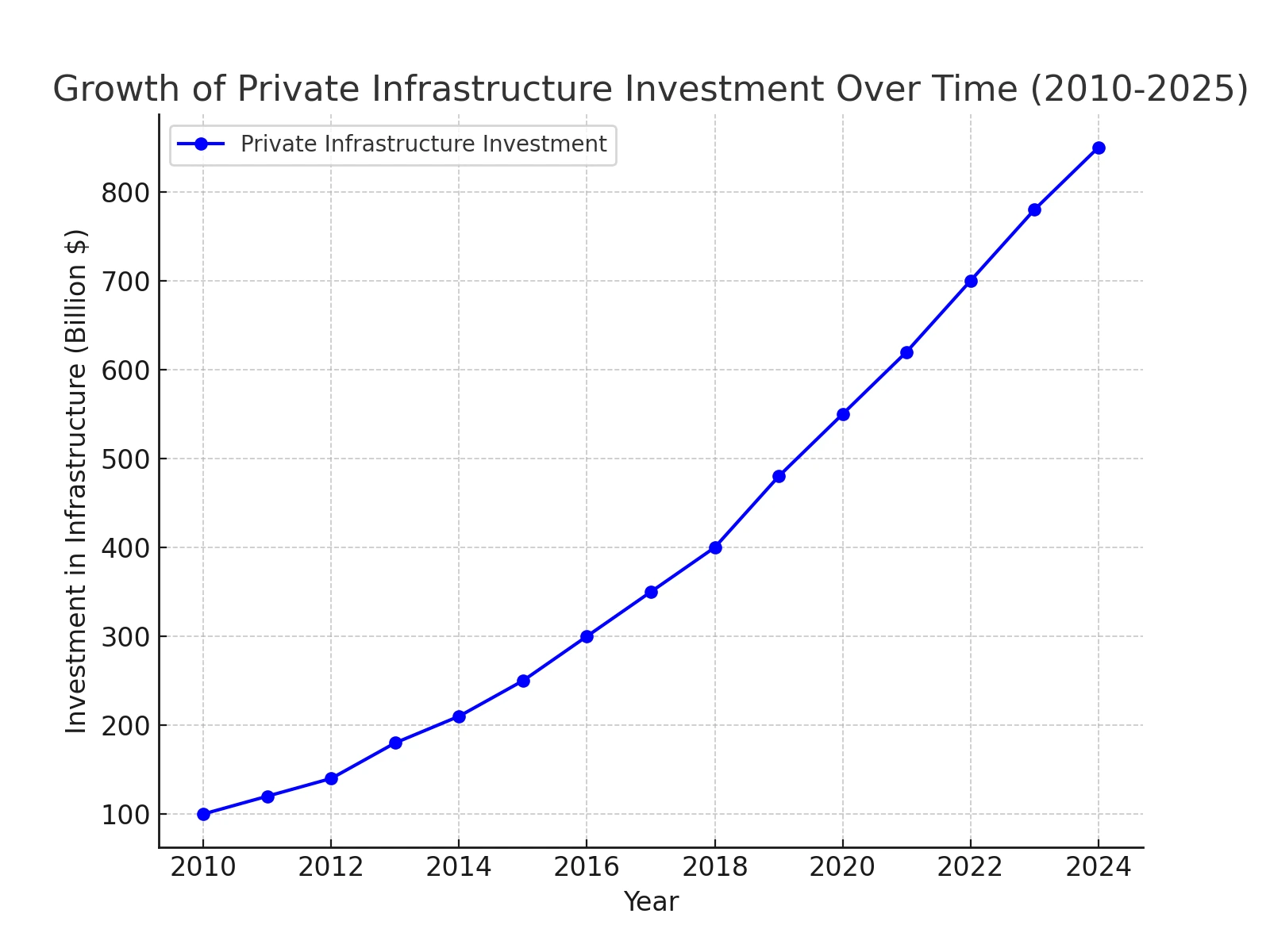

This graph illustrates the growth in private investment in infrastructure from 2010 to 2025, showing a steady increase in private capital participation globally.

The rise in private investment highlights a global shift towards financial partnerships that help governments bridge funding gaps and accelerate critical infrastructure development. Countries like the U.K., Australia, and Canada have successfully implemented PPP models, demonstrating the effectiveness of private capital in funding major infrastructure projects.

Successful Models of Private Investment in Infrastructure

- The U.K. Model: Public-Private Partnerships (PPPs)

- Australia's Infrastructure Funding Approach

- Singapore's Asset Recycling Strategy

- Chile's Concession System

- South Korea's Special Purpose Vehicle (SPV) Framework

The United Kingdom has successfully used PPP agreements to fund infrastructure projects such as Crossrail and high-speed rail networks. The involvement of the private sector in planning and implementation has resulted in more efficient completion of these projects.

Australia relies largely on private funding to fund infrastructure projects. The Sydney Metro project, one of the greatest train infrastructure projects in the Southern Hemisphere, received partial funding from private banking firms.

Singapore has pioneered an effective model where the government sells or leases existing infrastructure assets to private investors, then reinvests those proceeds into new priority infrastructure projects. This approach has enabled Singapore to fund its extensive public transportation network and world-class airport facilities while maintaining high service standards through carefully structured contracts with private operators.

Chile has developed a sophisticated concession model where private companies compete to build, operate, and maintain infrastructure through long-term contracts with guaranteed minimum revenue arrangements. This approach has transformed Chile's transportation network, with over 4,000 km of highways and numerous airports developed through private investment while protecting investors from demand risk.

South Korea has successfully implemented SPVs that bring together public institutions, private investors, and pension funds to finance major infrastructure developments. This model was instrumental in developing Songdo International Business District, a smart city built on reclaimed land. The SPV structure enables risk sharing while providing stable long-term returns for institutional investors like the National Pension Service.

"Countries that integrate private capital into infrastructure funding complete projects faster and more cost-effectively," notes Julio Herrera Velutini.

Julio Herrera Velutini's Blueprint for Private Banking in the United States Infrastructure

Julio Herrera Velutini proposes three critical reforms to strengthen private banking's role in US infrastructure development:

- Expand Public-Private Partnerships (PPPs) – To distribute financial risk and increase project efficiency.

- Create Incentives for Private Infrastructure Investment – Through tax credits and reduced regulatory barriers.

- Establish a National Infrastructure Investment Bank – To facilitate collaboration between government agencies and private financial institutions.

"A structured approach to private banking in infrastructure can help the U.S. modernize its roads, transit systems, and energy networks at a faster pace," says Julio Herrera Velutini.

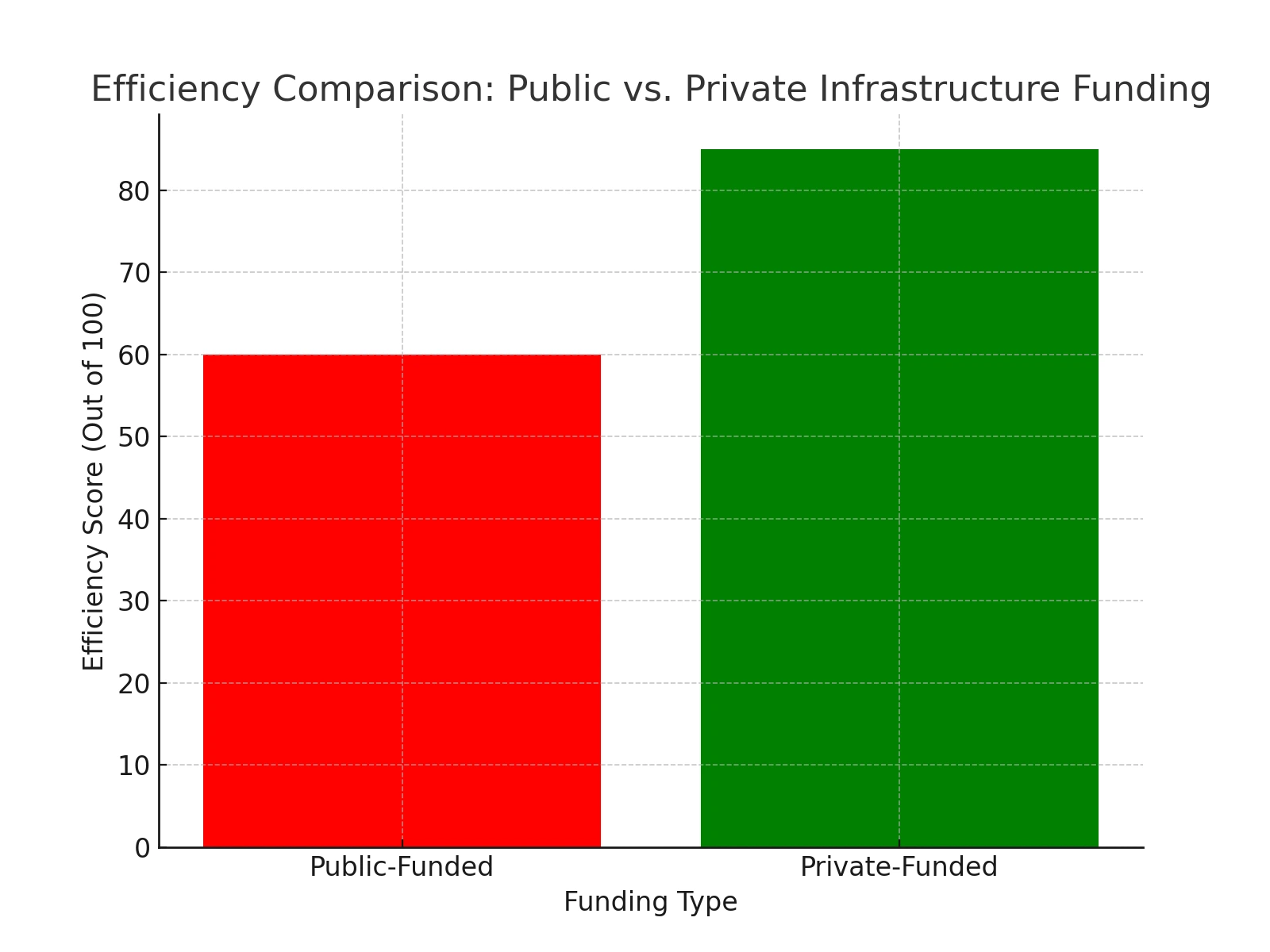

This graph compares publicly funded and privately funded infrastructure projects based on efficiency scores (out of 100) and average completion times (in years).

Private infrastructure funding can significantly improve efficiency and reduce delays, ensuring faster modernization of roads, bridges, and transit systems while easing the burden on public funds.

Conclusion: The Future of US Infrastructure Funding

Julio Herrera Velutini believes that private banking may transform infrastructure development in the United States by providing alternative funding choices that decrease public burdens while guaranteeing that vital projects proceed without unnecessary delays. By strengthening public-private partnerships, stimulating private capital investment, and building a national infrastructure investment framework, the United States can position itself for long-term economic growth and stability.